Structure of PAN

PAN is a ten-digit unique alphanumeric number issued by the Income Tax Department. PAN is

issued in the form of a laminated plastic card

BLGPXXXXXF

↖

Out of the first five characters, the first three characters represent the alphabetic series running

from AAA to ZZZ.

BLGPXXXXXF

↖

The fourth character of PAN represents the status of the PAN holder.

"P" stands for Individual

"C" stands for Company

"H" stands for Hindu Undivided Family (HUF)

"A" stands for Association of Persons (AOP)

"B" stands for Body of Individuals (BOI)

"G" stands for Government Agency

"J" stands for Artificial Juridical Person

"L" stands for Local Authority

"F" stands for Firm/ Limited Liability Partnership

"T" stands for Trust

BLGPCXXXXF

↖

Fifth character of PAN represents the first character of the PAN holder's last name/surname in

case of an individual. In case of non-individual PAN holders fifth character represents the first

character of PAN holder's name.

BLGPCXXXXF

↖

Next four characters are sequential numbers running from 0001 to 9999

BLGPCXXXXF

↖

Last character, i.e., the tenth character is an alphabetic check digit.

How to apply for PAN?

A person wishing to obtain PAN can apply for PAN by submitting the PAN application

form (Form 49A/49AA) along with the related documents and prescribed fees at the PAN

application center of UTIITSL or NSDL. An online application can also be made from the

website of UTIITSL or NSDL.

A resident person shall apply for PAN in form 49A and a non-resident person including a foreign

company shall apply for allotment of PAN in form 49AA

Individual applicants will have to affix two recent, coloured photograph (Stamp size 3.5 cms x

2.5. cms) on PAN application form.

Prescribed document must be furnished as a proof of ‘Identity’ ‘Address’ and ‘Date of Birth’.

Designation and Code of concerned Assessing Office of Income Tax Department will have to be

mentioned in PAN application form.

The address, phone numbers, etc., of PAN application centers of UTIITSL or NSDL at which

PAN application can be submitted can be obtained from :

• Website of Income Tax Department :www.incometaxindia.gov.in

• Website of UTIITSL :www.utiitsl.com

• Website of NSDL : www.tin-nsdl.com

Instant PAN Through Aadhaar Based e-KYC

Income-tax Dept. has launched a new functionality on the e-filing portal which allots a PAN to

the assessee on basis of his Aadhaar Number. PAN is issued in PDF format to applicants, which is free of cost

The salient points of this facility are:

- The applicant should have a valid Aadhaar which is not linked to any other PAN.

- The applicant should have his mobile number registered with Aadhaar.

- This is a paper-less process and applicants are not required to submit or upload any documents.

- The applicant should not have another PAN. Possession of more than one PAN will result in penalty under section 272B(1) of Income-tax Act (10,000).

This facility can be used by an assessee only if the following conditions are fulfilled:

a) He has never been allotted a PAN;

b) His mobile number is linked with his Aadhaar number;

c) His complete date of birth is available on the Aadhaar card; and

d) He should not be a minor on the date of application for PAN

How to apply for instant PAN

- Go to https://www.incometaxindiaefiling.gov.in/home and click on the link

‘Instant PAN’ through Aadhaar' given on the right hand side

- Click on 'Get New PAN’

- Enter the Aadhaar No. of the Applicant

- Enter the OTP received on the mobile number linked with the Aadhaar No.

- Validate the Aadhaar Details

- Validate Email-id

7. Download the e-PAN

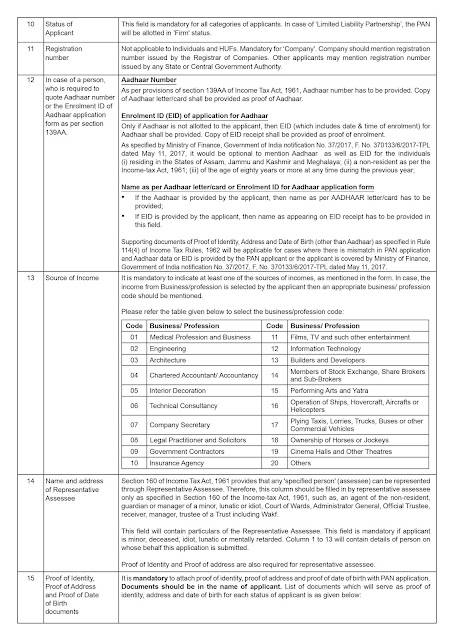

Instructions For Filling Form_49A

Thanks for sharing the knowledgeable information about PAN Card

ReplyDeleteYour article is good to understand, are you interested in doors and windows? Our service is helpful to you.

ReplyDeleteModern aluminium doors in chennai

Best Aluminium Windows in Chennai

upvc ventilator window in Chennai